|

|

|

|

|

|

|

|

I would like to move on to the explanation about the management of Urban Retail Properties.

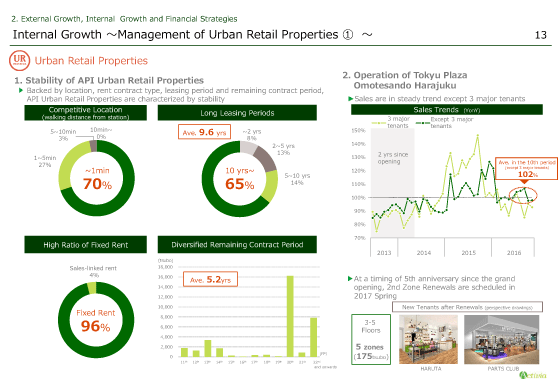

Pie charts 1. on the left side shows the data indicating the stability of Urban Retail Properties in our portfolio. This asset category is characterized by its remarkable stability. 70% of these properties are located 1-minute walk from the nearest station. The average contract term is 9.6 years while the ratio of contracts the term of which is 10 years or longer is 65%. Fixed rent accounts for 96% and the average remaining contract period is 5.2 years.

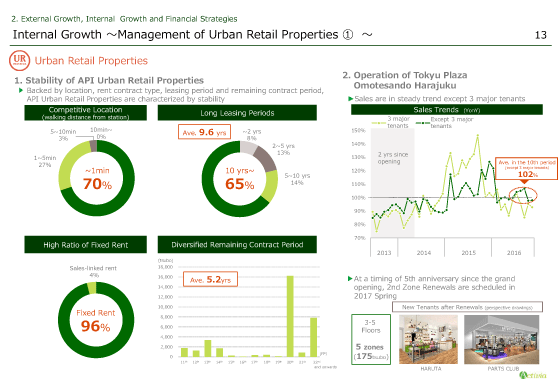

Chart 2. on the right shows the operational status of Tokyu Plaza Omotesando Harajuku, our flagship property. While sales of three major shops along the street have grown weaker since March 2016, sales of shops other than these three have continued to go strong, as the year-on-year sales during the 10th period were 102% on average.

The second renewal is scheduled at this property at the timing of the 5th anniversary of the opening with an aim to achieve further growth in the future. Lease contracts for some sections were already executed. This renewal plan is aimed to maintain news value of the property and to boost competitiveness.

Please turn to the next page.

|

|

|