|

|

|

|

|

|

|

|

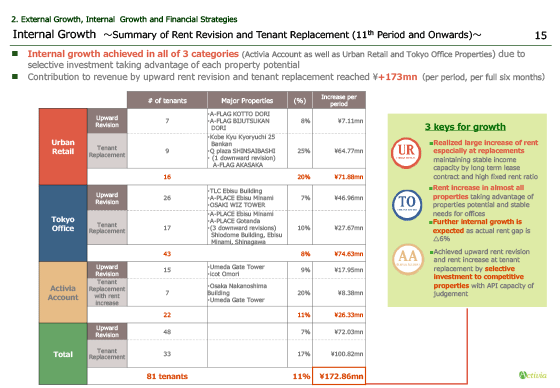

Next, let me talk about rent revisions and tenant replacement to be implemented in 11th period and onward.

In "Urban Retail Properties", we have achieved significant rent increase by proactively pursuing tenant replacement upon contract expiration. We have achieved an increase of approximately ¥7.1 million through rent revision and approximately ¥64.8 million through tenant replacement, for a total revenue contribution of approximately ¥71.9 million per normalized period.

In "Tokyo Office Properties", we are seeing constant increases in rents from both rent revision and tenant replacement, backed by actual rent gaps in addition to property potential and solid needs from office tenants. We have achieved rent increase of approximately ¥47 million through rent revision and approximately ¥27.7 million through tenant replacement, for a total revenue contribution of approximately ¥74.6 million.

In "Activia Account Properties", we have achieved rent increase of around ¥18 million through rent revision and around ¥8.4 million through tenant replacement, for a total revenue contribution of approximately ¥26.3 million, due to the individual competitiveness of "Umeda Gate Tower" and "Osaka Nakanoshima Building".

Totaling the three categories, there were 48 tenants where rents were revised with around ¥72 million up, and 33 new tenants who replaced with an increase of around ¥101 million. And total revenue contribution reaches ¥173 million with 81 tenants per normalized period. Our achievement of internal growth across all three categories should be the result of selective investment in which we focus on location and quality of properties.

|

|

|